Market Update July 16, 2024

“Markets are built on bad news”

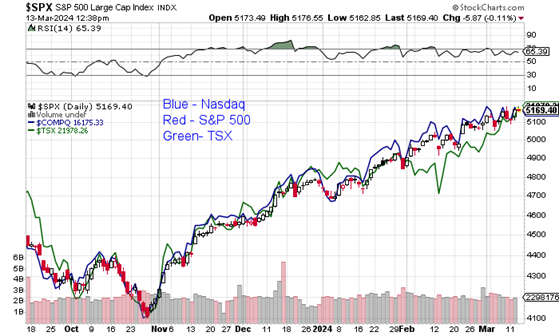

The Nasdaq (technology index) in the U.S. is up 23.3% YTD…

The broad-based S&P 500 index in the U.S. is up 18.81% YTD…

The U.S market is doing very well this year, and their economy has been quite robust as well.

The Canadian broad based TSX index is up 9.71% YTD…

In your portfolio today, the Canadian side of the portfolio is likely providing you a lot of good dividend income where the U.S. side of the portfolio is providing you growth.

Here is an update of my team’s contact information:

Trading:

Rob Hunter 250 953 8416

Senior Wealth Advisor

Campbell Hunter 250 953 8422

Wealth Advisor 604 623 3282

Administration:

Khanh Vu 250 953 8415

Associate

Comet Tang 250 220 9021

Wealth Associate

Stephanie Hunter 250 953 8442

Associate

Here is a short recent economic update from our Chief Economist…

https://www.youtube.com/watch?v=dz9aVUf3HVk&list=PLuERhy6Kozuc4EGiwvFhUzo7uQBqPhneM&index=1

Trust your summer is going well!

If you have any questions, we are a phone call away.

Best,

National Bank Financial

Rob Hunter

Senior Wealth Advisor

Sources: Stockcharts.com, National Bank Economics

National Bank Financial – Wealth Management (NBFWM) is a division of National Bank Financial Inc. (NBF), as well as a trademark owned by National Bank of Canada (NBC) that is used under license by NBF. NBF is a member of the Canadian Investment Regulatory Organization (CIRO) and the Canadian Investor Protection Fund (CIPF), and is a wholly owned subsidiary of NBC, a public company listed on the Toronto Stock Exchange (TSX: NA).

The opinions expressed herein do not necessarily reflect those of National Bank Financial. The particulars contained herein were obtained from sources we believe to be reliable but are not guaranteed by us and may be incomplete. The opinions expressed consider a number of factors including our analysis and interpretation of these particulars, such as historical data, and are not to be construed as a solicitation or offer to buy or sell the securities mentioned herein. Unit values and returns will fluctuate, and past performance is not necessarily indicative of future performance. Important information regarding a fund may be found in the prospectus. The investor should read it before investing.

The particulars contained herein were obtained from sources we believe to be reliable but are not guaranteed by us and may be incomplete. The opinions expressed are based upon our analysis and interpretation of these particulars and are not to be construed as a solicitation or offer to buy or sell the securities mentioned herein. The opinions expressed do not necessarily reflect those of NBF.

The securities or sectors mentioned herein are not suitable for all types of investors. Please consult your Wealth Advisor to verify whether the securities or sectors suit your investor’s profile as well as to obtain complete information, including the main risk factors, regarding those securities or sectors.

I have prepared this report to the best of my judgment and professional experience to give you my thoughts on various financial aspects and considerations. The opinions expressed represent solely my informed opinions and may not reflect the views of NBF.

Selling calls against stock (Covered Writing): Shares may need to be sold at the strike price of the option at any time prior to expiration. If the calls are assigned, further opportunity for appreciation in the underlying security above the strike price is foregone.

Risk/Reward of the strategy = Strike price minus the purchase price of the underlying plus the premium received from the sale of the call. The maximum loss is the same as holding a long position less the premium received.

The investment advice given only applies to residents of the provinces of British Columbia, Alberta, Manitoba, Saskatchewan, Ontario, New Brunswick and Quebec.

National Bank Financial is a member of the Canadian Investor Protection Fund.