Market Update February 2024

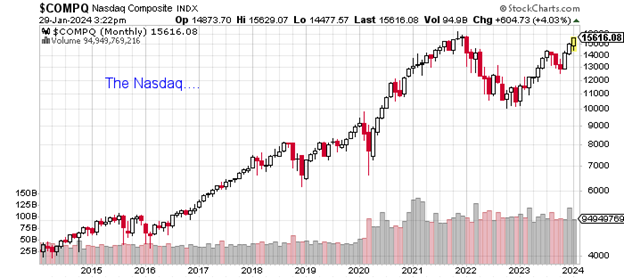

Seven tech stocks are driving the valuation gains for the U.S. market. In fact, the so called Magnificent Seven (ALPHABET (Google), AAPLE, AMAZON, MICROSOFT, NVIDIA, TESLA, META (Facebook)) recently accounted for half the valuation of the Nasdaq index.

Many are trading above rising analyst targets as momentum takes over.

My mind can’t help but think back to 2000 when Nortel alone represented 35% of the weight of the TSX here in Canada. Back then, BCE owned part of Nortel so the combined weight of those two stocks was more than 55% of the TSX! It didn’t last.

I fully believe that AI can be bigger than the internet. However, at this juncture, one of two things will happen. These companies will report incredible earnings this week – or miss expectations. This happened with Tesla last week when it warned of weaker growth this year and the entire Nasdaq pulled back 5% on that news.

Of course, while the hopes for change via technology are one thing, the other is direction interest rates. Technology stocks perform better with the hope of lower interest rates. The Federal Reserve meets on Wednesday and while there has been plenty talk about lowering rates, that hasn’t happened – yet.

The U.S. economy seems to be doing rather well despite public sentiment. The measure by which the Federal Reserve measures core inflation is indicating that inflation has dropped significantly. Unemployment in the U.S. is still quite low and the jobs report comes out Friday. Maybe, the Fed might be less inclined to lower rates soon – if they don’t feel the need.

In terms of the next few years, I don’t think it will matter much for technology stocks. Near-term, I have less conviction.

TRYING TO BE RIGHT

Invest into smaller positions in this sector as earnings play out over the next few quarters to see if earnings are catching up with prices. That way, you are not overweight if they pull back on an earnings miss. On the other hand, if earnings are fantastic, you still have exposure.

TESLA $190

< $38.30> Recent premium available on the Tesla January 2025 $190 Call.

$38.30 represents 20% of the value of the stock. If assigned, the profit would be 25.2%

The stock could drop $38.30 before it lost money.

*The volatility of this stock makes it good for illustrative purposes. I am not recommending everyone owns TESLA.

I have prepared this commentary to give you my thoughts on various investment alternatives and considerations which may be relevant to your portfolio. This commentary reflects my opinions alone and may not reflect the views of National Bank Financial Group. In expressing these opinions, I bring my best judgment and professional experience from the perspective of someone who surveys a broad range of investments. Therefore, this report should be viewed as a reflection of my informed opinions rather than analyses produced by the Research Department of National Bank Financial.

Best regards,

National Bank Financial

Rob Hunter

Senior Wealth Advisor

Sources: Stockcharts.com, BNN, Bloomberg, Globe & Mail, Yahoo Finance

National Bank Financial – Wealth Management (NBFWM) is a division of National Bank Financial Inc. (NBF), as well as a trademark owned by National Bank of Canada (NBC) that is used under license by NBF. NBF is a member of the Canadian Investment Regulatory Organization (CIRO) and the Canadian Investor Protection Fund (CIPF), and is a wholly-owned subsidiary of NBC, a public company listed on the Toronto Stock Exchange (TSX: NA).

This information was prepared by Rob Hunter, a Senior Wealth Advisor with National Bank Financial. The particulars contained herein were obtained from sources that we believe reliable but are not guaranteed by us and may be incomplete.

The opinions expressed are based on our analysis and interpretation of these particulars and are not to be construed as solicitation or offer to buy or sell the securities mentioned herein. National Bank Financial may act as financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive remuneration for its services. Rob Hunter, National Bank Financial and/or its officers, directors, representatives, and associates may have a position in the securities mentioned herein and may make purchases and / or sales of these securities from time to time in the open market or otherwise.

The opinions expressed herein do not necessarily reflect those of National Bank Financial. Several of the securities mentioned in this article may not be followed by National Bank Financial’s Research department.

The securities mentioned (inclusive of option strategies) in this article are not necessarily suitable to all types of investors. Please consult your investment advisor to discuss investment risks. All prices and rates are subject to change without notice. Stocks typically fluctuate in value. Stock values can go to zero.

Selling calls against stock (Covered Writing): Shares may need to be sold at the strike price of the option at any time prior to expiration. If the calls are assigned, further opportunity for appreciation in the underlying security above the strike price is foregone.

Risk/Reward of the strategy = Strike price minus the purchase price of the underlying plus the premium received from the sale of the call. The maximum loss is the same as holding a long position less the premium received.

The investment advice given only applies to residents of the provinces of British Columbia, Alberta, Manitoba, Saskatchewan, Ontario, New Brunswick and Quebec.

National Bank Financial is a member of the Canadian Investor Protection Fund.