Market Update December 2024

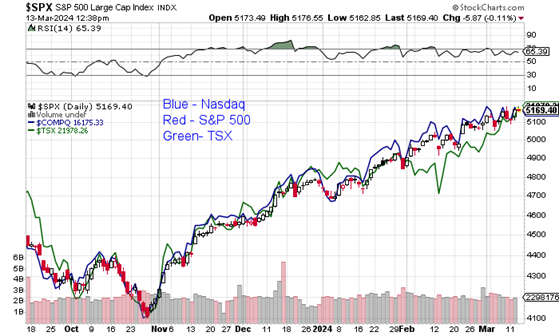

The S&P 500 is up over 6.5% since the first interest cut by the Federal Reserve in September. Likewise, the TSX here in Canada is up over 15% since the Bank of Canada started cutting rates back in June.

Both Canadian and U.S. markets have been strong since my October letter as we have entered a period technically (November – April) that has been the strongest part of the calendar year for markets historically.

Remember that markets are forward looking or often ahead of the actual underlying economy. This is the only way for me to explain the Canadian market given current weak GDP growth and low productivity. I note too, that Canada’s energy policy appears inverse to that of the incoming U.S. administration.

For me, the election result was a surprise in that one side captured both the White House and Congress. This means that policy changes may come more easily.

More recently, an appointment has in part, impacted a sector of the market when Mr. Trump appointed Robert Kennedy Junior (RFK) for Health. This appears to have coincided with some selling in the pharmaceutical sector.

That department oversees the CDC, FDA, NIH, CMS along with other agencies related to human health. Kennedy is a well-known Pharma skeptic, who plans to drastically change healthcare and health regulations. Many healthcare stocks, especially vaccine manufacturers have sold off because of this news. It is still unclear what specific policy changes that RFK will implement.

That said, healthcare is generally a resilient industry that handles short term volatility well, and tends to recover due to the inelastic nature of the underlying product demand. Much of the recent pullback appears to stem from uncertainty rather than clearly defined outcomes that would directly harm healthcare companies.

I believe we may see some near-term volatility in markets over the near-term from the coming change of U.S. government.

Earnings remain strong on both sides of the border and three banks, Royal, National and Commerce raised their dividends with earnings announcements in the last week.

Markets…

Canada’s TSX is up 22.86% ytd

S&P 500 (SPX) The U.S. broad market index is up 27.54% ytd

Nasdaq the technology laden index is up 31.94% ytd

If you have any questions, we are a phone call away.

I have prepared this commentary to give you my thoughts on various investment alternatives and considerations which may be relevant to your portfolio. This commentary reflects my opinions alone and may not reflect the views of National Bank Financial Group. In expressing these opinions, I bring my best judgment and professional experience from the perspective of someone who surveys a broad range of investments. Therefore, this report should be viewed as a reflection of my informed opinions rather than analyses produced by the Research Department of National Bank Financial.

Best,

National Bank Financial

Rob Hunter

Senior Wealth Advisor

Sources: Stockcharts.com, National Bank Economics, Evolve ETFs

National Bank Financial – Wealth Management (NBFWM) is a division of National Bank Financial Inc. (NBF), as well as a trademark owned by National Bank of Canada (NBC) that is used under license by NBF. NBF is a member of the Canadian Investment Regulatory Organization (CIRO) and the Canadian Investor Protection Fund (CIPF), and is a wholly owned subsidiary of NBC, a public company listed on the Toronto Stock Exchange (TSX: NA).

The opinions expressed herein do not necessarily reflect those of National Bank Financial. The particulars contained herein were obtained from sources we believe to be reliable but are not guaranteed by us and may be incomplete. The opinions expressed consider a number of factors including our analysis and interpretation of these particulars, such as historical data, and are not to be construed as a solicitation or offer to buy or sell the securities mentioned herein. Unit values and returns will fluctuate, and past performance is not necessarily indicative of future performance. Important information regarding a fund may be found in the prospectus. The investor should read it before investing.

The particulars contained herein were obtained from sources we believe to be reliable but are not guaranteed by us and may be incomplete. The opinions expressed are based upon our analysis and interpretation of these particulars and are not to be construed as a solicitation or offer to buy or sell the securities mentioned herein. The opinions expressed do not necessarily reflect those of NBF.

The securities or sectors mentioned herein are not suitable for all types of investors. Please consult your Wealth Advisor to verify whether the securities or sectors suit your investor’s profile as well as to obtain complete information, including the main risk factors, regarding those securities or sectors.

I have prepared this report to the best of my judgment and professional experience to give you my thoughts on various financial aspects and considerations. The opinions expressed represent solely my informed opinions and may not reflect the views of NBF.

Selling calls against stock (Covered Writing): Shares may need to be sold at the strike price of the option at any time prior to expiration. If the calls are assigned, further opportunity for appreciation in the underlying security above the strike price is foregone.

Risk/Reward of the strategy = Strike price minus the purchase price of the underlying plus the premium received from the sale of the call. The maximum loss is the same as holding a long position less the premium received.

The investment advice given only applies to residents of the provinces of British Columbia, Alberta, Manitoba, Saskatchewan, Ontario, New Brunswick and Quebec.

National Bank Financial is a member of the Canadian Investor Protection Fund.