Market Update November 2023

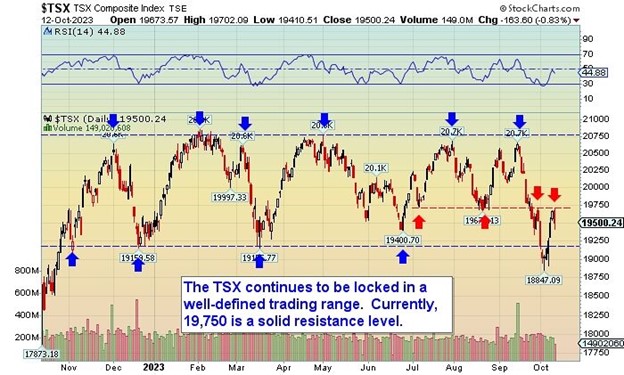

Seasonally, September/October tend to be the worst months for the market in the calendar year historically and this year was no exception. That said, the first week of November proved to be the best week for the TSX since 2020. Sentiment about central bankers being finished raising interest rates proved positive news for markets along with mix of positive earnings surprises as companies report their quarter.

Canada is having a rough time. Productivity is now the lowest in G7 (about zero) and we just increased our money supply by nearly one third over the last three years. That is likely telling if you have any sense of a declining standard of living. We also lack capital investment. At an economic presentation I attended last week with our Chief Economist, he explained CPP, The Canada Pension Plan has $200 billion allocated in equities around the world and only $10 billion is invested in Canada. Just $1.7 billion is invested in Alberta.

My challenge is to balance the need for income with growth in a portfolio. Canada has a positive history as a dividend paying market. While growth in Canada is currently flat, I have found exposure to the larger and more diverse U.S. market a great catalyst to portfolios.

By the way, the kind of sideways market illustrated above is usually great for covered call writing as we approach large call option maturities in December and January.

I want to remind you about the positives of dividend stocks in this environment. For starters the yields are fantastic relative to fixed income. Dividends are also taxed at the lowest rate where fixed income (interest) is taxed at the highest rate. Most importantly, dividends tend to grow in stocks with a history of dividend growth.

Last update, I included a chart on National Bank (NA).

Investors tend to sometimes forget that dividend growth stocks tend to keep raising their dividends – as many of the banks have done this year despite weakness in the Canadian market. Anyone who purchased National Bank at $39 ten years ago, today has a dividend yield of approximately 10.46% In a taxable account the dividend tax credit would make that an approximate pre-tax interest equivalent yield of 14.6%. Not bad, despite banks pulling back near-term about 17% this year.

Market volatility is normal in the stock market. Accept it. Think two years – not two weeks.

Rising interest rates may be squeezing the economy in part – which is the intention of central bankers, but most economists expect interest rates to fall in the first half of the next year.

Best wishes as we head into winter.

I have prepared this commentary to give you my thoughts on various investment alternatives and considerations which may be relevant to your portfolio. This commentary reflects my opinions alone, and may not reflect the views of National Bank Financial Group. In expressing these opinions, I bring my best judgment and professional experience from the perspective of someone who surveys a broad range of investments. Therefore, this report should be viewed as a reflection of my informed opinions rather than analyses produced by the Research Department of National Bank Financial.

Best regards,

National Bank Financial

Rob Hunter

Senior Wealth Advisor

Sources: Technical Speculator, Stockcharts.com, National Bank Economics, Bloomberg, Globe & Mail

National Bank Financial – Wealth Management (NBFWM) is a division of National Bank Financial Inc. (NBF), as well as a trademark owned by National Bank of Canada (NBC) that is used under license by NBF. NBF is a member of the Investment Industry Regulatory Organization of Canada (IIROC) and the Canadian Investor Protection Fund (CIPF), and is a wholly-owned subsidiary of NBC, a public company listed on the Toronto Stock Exchange (TSX: NA).

The information contained herein has been prepared by Rob Hunter, a Wealth Advisor at NBF. The opinions expressed do not necessarily reflect those of NBF.

The opinions expressed herein do not necessarily reflect those of National Bank Financial. The particulars contained herein were obtained from sources we believe to be reliable, but are not guaranteed by us and may be incomplete. The opinions expressed consider a number of factors including our analysis and interpretation of these particulars, such as historical data, and are not to be construed as a solicitation or offer to buy or sell the securities mentioned herein. Unit values and returns will fluctuate and past performance is not necessarily indicative of future performance. Important information regarding a fund may be found in the prospectus. The investor should read it before investing.

The particulars contained herein were obtained from sources we believe to be reliable, but are not guaranteed by us and may be incomplete. The opinions expressed are based upon our analysis and interpretation of these particulars and are not to be construed as a solicitation or offer to buy or sell the securities mentioned herein. The opinions expressed do not necessarily reflect those of NBF.

I have prepared this report to the best of my judgement and professional experience to give my thoughts on various financial aspects and considerations. The opinions expressed represent solely my informed opinions and may not reflect the views of NBF.

Several of the securities mentioned in this article may not be followed by National Bank Financial’s Research department. The investment advice given only applies to residents of the provinces of British Columbia, Alberta, Manitoba, Saskatchewan, Ontario, and Quebec. National Bank Financial is a member of the Canadian Investor Protection Fund.