- Bond market yields moving up / Banks raise mortgage rates / Bank of Canada raises ¼%

- Pullback in stock prices, poses potential opportunity for Canadian banks

- Commodity laden Canadian stock market rolls over with summer to negative year-to-date return

- U.S. stock market continues to hit new highs / Tech laden NASDAQ leads / Healthcare breaks out to upside.

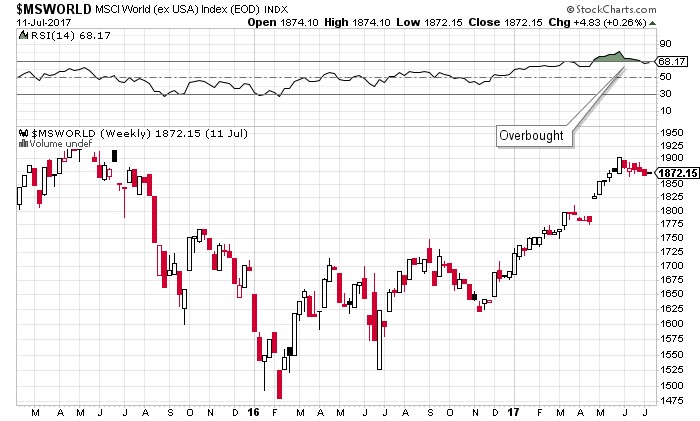

- Most global markets appear overbought

- Client survey

- Stay in touch this summer

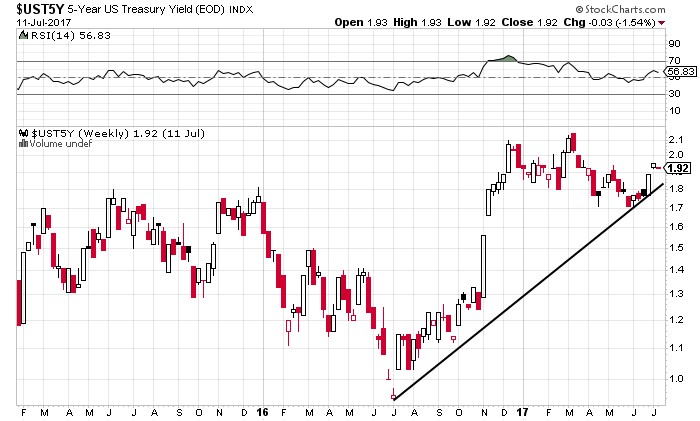

5 year U.S. bond yields (below) have been rising for one year.

Here in Canada, bond yields have been rising more recently and over the last few years, we have had a few false starts to any notion of a rising yield curve. That said, Canadian banks raised mortgage rates last week and today, (July 12/17) the Bank of Canada raised their overnight rate to banks +.25 percentage point to .75 percentage point for the first time in 7 years.

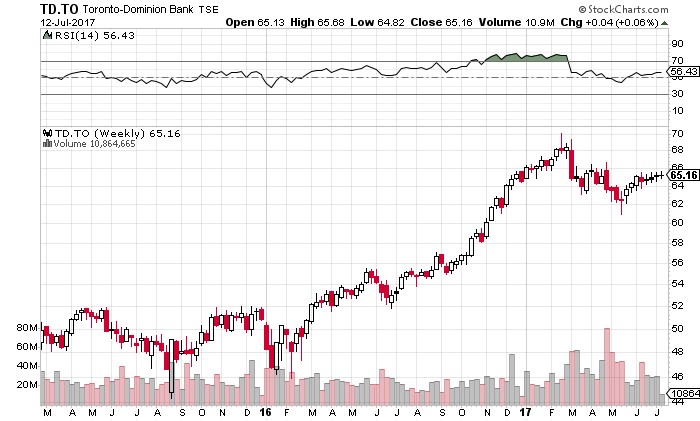

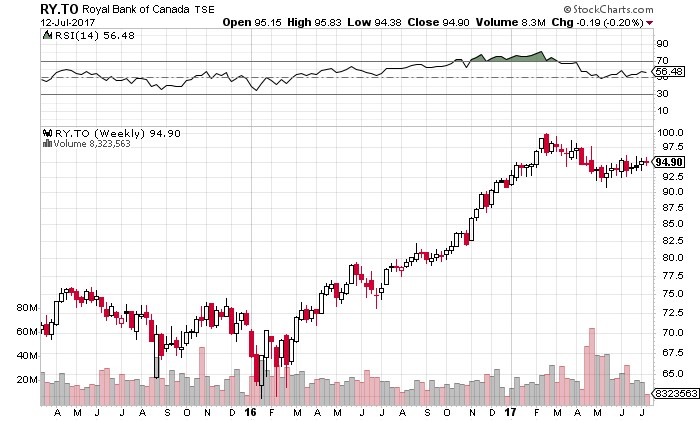

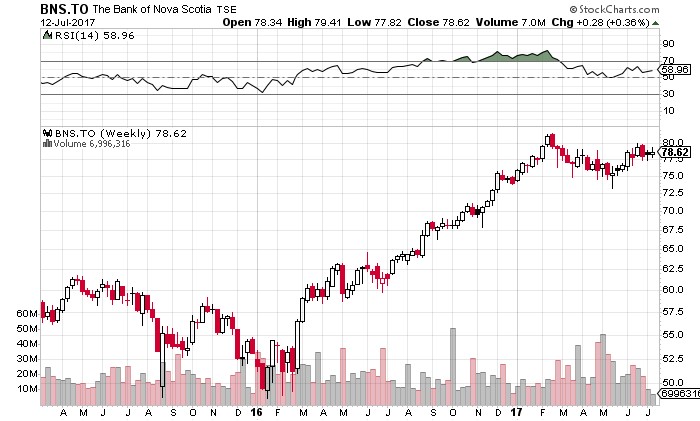

Significant? We may be a bit conditioned to 35 years of falling interest rates. High real estate values and accompanying mortgages are the obvious risk for lenders. That said, there has been a recent pullback in Canadian banks over the last 3-4 months and I think it may pose an opportunity, in particular with those banks that generate revenue outside of Canada.

TD Bank (below)

Royal Bank (below)

Bank of Nova Scotia (below)

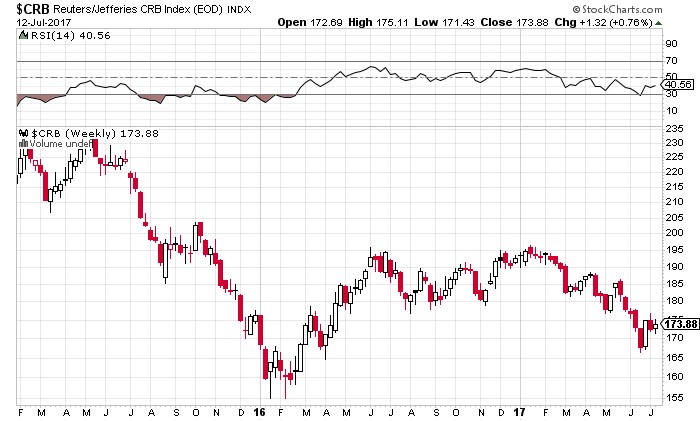

Canada is a commodity based economy. The commodity index (below) has traded down year-to-date…

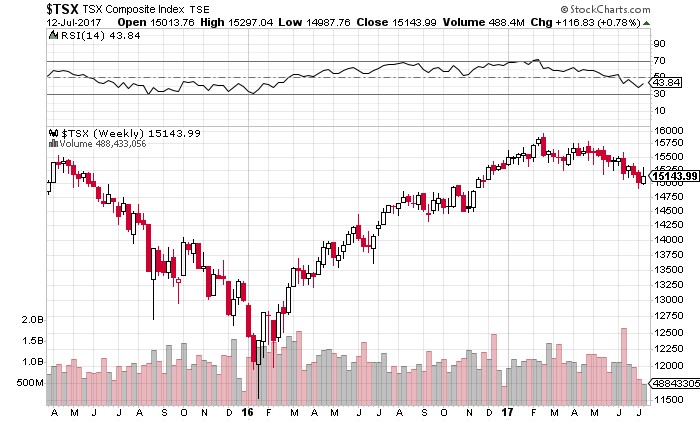

…and so has the Canadian market. The TSX (below) is NEGATIVE – 1.7% year-to-date, the worst performing index that I follow.

While the Canadian stock market looks weak right now with our commodity weighted exposure, don’t forget that commodities are cyclical as in the short-term, winter is to summer. Value investors may soon have opportunities in this currently underperforming market as we move closer toward winter.

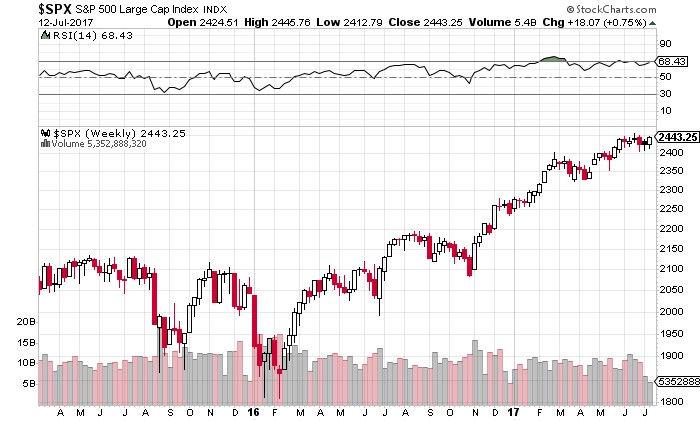

The current contrast of course, is the much more diversified and U.S. dollar based market where the underlying economy continues to grow with low unemployment. Below, is the S&P 500…

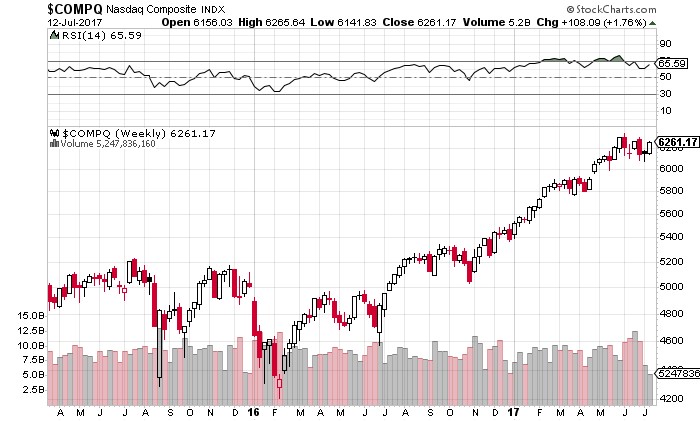

The technology laden NASDAQ market (below) has been the leader in North America, second only to Hong Kong’s Hang Seng index year-to-date.

Most global markets for the most part, appear a bit overbought. The world market index below…

Canadian dollar (wholesale) is $1.27 to the U.S. dollar. The U.S. dollar has come off slightly over the last few months while the Canadian dollar has risen a bit, perhaps in anticipation of an interest rate hike. Longer-term, I believe we are five years into what historically, is a 14-18 year U.S. dollar stock cycle which historically, has favoured U.S. dollar denominated assets.

Canadian/Euro $1.455 (wholesale)

Canadian/Pound $1.64 (wholesale)

Oil (WTIC) $45.54

Natural Gas $3.00

I would like to offer a big thank you to everyone who took the time to participate in our recent client survey. This survey serves you. The results help shape our objectives over the months and year to best address your needs.

Please mark your calendar now for our annual client breakfast which will be held on Saturday morning September 23rd. This event has in the past proven to be a fun, casual opportunity to converse about relevant topics over breakfast and an opportunity for Q&A. The final agenda will come with your invitation but I will include a discussion about a common client fear, “how will my kids afford a home”

Enjoy the great weather!

I have prepared this commentary to give you my thoughts on various investment alternatives and considerations which may be relevant to your portfolio. This commentary reflects my opinions alone, and may not reflect the views of National Bank Financial Group. In expressing these opinions, I bring my best judgment and professional experience from the perspective of someone who surveys a broad range of investments. Therefore, this report should be viewed as a reflection of my informed opinions rather than analyses produced by the Research Department of National Bank Financial.

Best,

National Bank Financial

Rob Hunter

Vice President

Senior Investment Advisor

Sources: Technical Speculator, Stockcharts, Reuters