- Market Summary

- Canada down / USA up

- July – 2016 Canada up / USA (up and down)

- Fixed income versus Dividends

- Enhancing income by selling calls

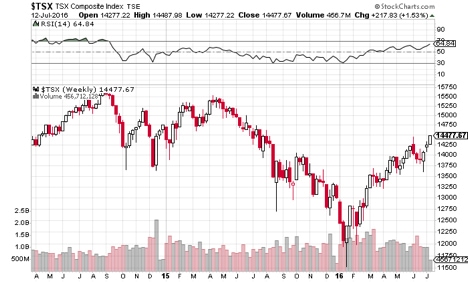

After cyclical downturn in commodities, Canada’s market bottomed early in the New Year and has been rebounding since January.

West Texas Intermediate $47.57 (low $27.67)

Natural Gas $2.70 (low $1.60)

Canadian dollar / U.S. – spot $1.30 (low $1.47)

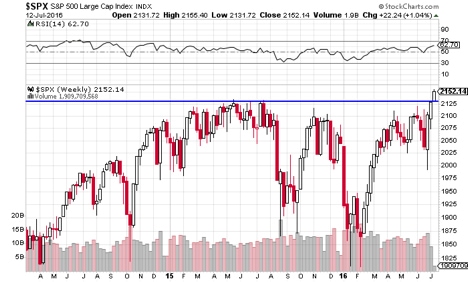

While economic data out of the U.S. is encouraging, the market doesn’t like uncertainty and that is what the U.S. Presidential election has been dishing up. While the S&P hit a ‘new high’ this week, it is marginal to a market that has been moving sideways for one year.

*All prices at time of writing and subject to change without notice.

Fixed Income versus Dividends…

A common frustration for investors wanting income is almost zero interest rates.

Five year Canada bonds currently 0.52%!! Government bonds offer a 100% guarantee with a fixed maturity date. Today, they often offer a negative rate of return after tax and inflation.

Dividends paid by Canadian corporations are not guaranteed and nor is capital invested. That said, investors can partially offset some of that risk by diversifying into multiple stocks paying dividends.

The current yield on the TSX 60 (holding of top 60 TSX stocks) currently pays a dividend of 2.88% but several banks and pipelines pay 4%. While interest from most fixed income is taxed at the highest rate, dividends are most often taxed at the lowest!

Here is what 2.88% and 4% dividend income approximately looks like as a pre-tax interest equivalent (PTIE) after applying the dividend tax credit. It will vary slightly with different tax rates.

Dividend 2.88% 4.0% *PTIE 4.03% 5.6%

Enhancing income by selling calls.

Selling a call creates an obligation to sell a stock for a fixed price for a fixed period of time – if called upon to do so. I generally like selling calls at a price higher than what I paid for the stock. That obligation however, eliminates upside beyond that higher price. In return the seller of the call, receives money which is tax friendly as it is only half taxable as a capital gain.

So effectively, selling calls enhances income, reduces risk and creates a market driven exit strategy out of stock.

In Canada, only 10% of advisors are licensed to deal in these options and only 5% practice. I have been adding this value for clients throughout my career and consider it a core to my value proposition as an advisor.

Can it be relevant? Yes by virtue of the fact that selling calls creates additional income in a portfolio that would not otherwise be there. To discuss the pros and cons or selling calls further feel free to contact me at your convenience.

I have prepared this commentary to give you my thoughts on various investment alternatives and considerations which may be relevant to your portfolio. This commentary reflects my opinions alone, and may not reflect the views of National Bank Financial Group. In expressing these opinions, I bring my best judgment and professional experience from the perspective of someone who surveys a broad range of investments. Therefore, this report should be viewed as a reflection of my informed opinions rather than analyses produced by the Research Department of National Bank Financial.

Sources: Thomson Reuters, Stockcharts.com, BNN (How high income earners ease their tax burden – March 2016)

Best,

National Bank Financial

Rob Hunter

Vice-President

Senior Investment Advisor

National Bank Financial is an indirect wholly-owned subsidiary of National Bank of Canada. The National Bank of Canada is a public company listed on the Toronto Stock Exchange (NA: TSX). This information was prepared by Rob Hunter, an Investment Advisor with National Bank Financial and Life Underwriter with National Bank Insurance. The particulars contained herein were obtained from sources that we believe reliable but are not guaranteed by us and may be incomplete. The opinions expressed are based on our analysis and interpretation of these particulars and are not to be construed as solicitation or offer to buy or sell the securities mentioned herein. National Bank Financial may act as financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive remuneration for its services. Rob Hunter, National Bank Financial and/or its officers, directors, representatives, and associates may have a position in the securities mentioned herein and may make purchases and / or sales of these securities from time to time in the open market or otherwise. The opinions expressed herein do not necessarily reflect those of National Bank Financial. Several of the securities mentioned in this article may not be followed by National Bank Financial’s Research department. The securities mentioned (inclusive of income trusts and option strategies) in this article are not necessarily suitable to all types of investors. Income trusts and preferred shares are equity investments. Please consult your investment advisor to discuss investment risks. All prices and rates are subject to change without notice. Stocks typically fluctuate in value. Stock values can go to zero. Selling calls against stock (Covered Writing): Shares may need to be sold at the strike price of the option at any time prior to expiration. If the calls are assigned, further opportunity for appreciation in the underlying security above the strike price is foregone. Risk/Reward of the strategy = Strike price minus the purchase price of the underlying plus the premium received from the sale of the call. The maximum loss is the same as holding a long position less the premium received. The investment advice given only applies to residents of the provinces of British Columbia, Alberta, Manitoba and Ontario. National Bank Financial is a member of the Canadian Investor Protection Fund.