Market Update … tale of two countries

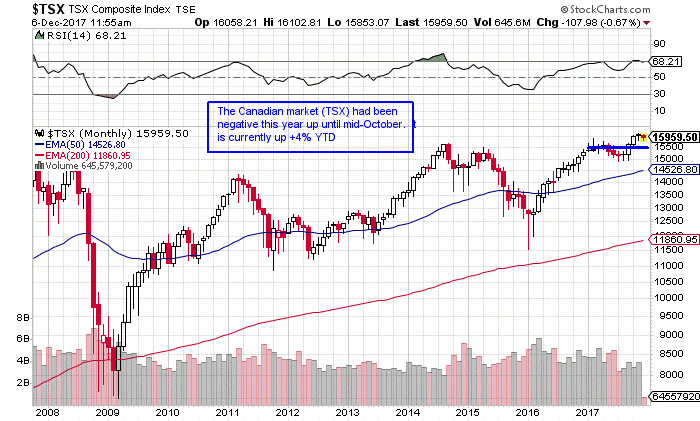

In Canada, weakness in commodities held the index back most of this year, though we have seen limited strength in both materials and energy of late as we move into winter. Strength in the Canadian market was most notable in the financials.

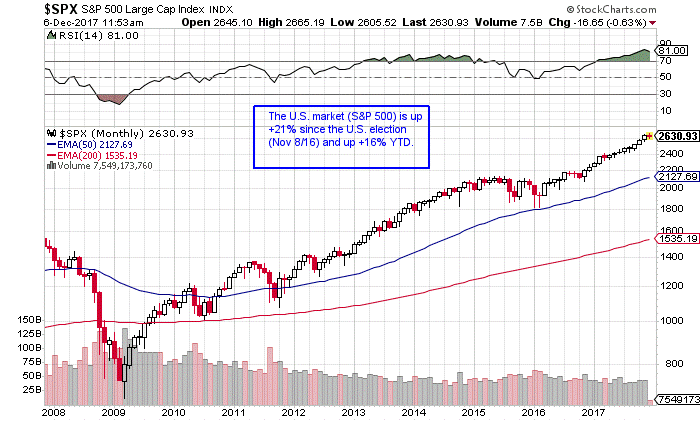

In the U.S. market, strength was most noticeable in the technology and financial stocks this year.

Essentially, Canada has served well as great haven for dividend seekers as even the downtrodden energy sector provides among the best dividend yields. The American market has been the growth catalyst and I repeat myself in saying that I believe the American market will continue to do so on a relative basis as we remain in a U.S. dollar driven stock cycle.

That said, it would historically, be unusual for the American market to repeat this year’s performance next. Hints of a fully valued U.S. market may have come from Q3 earnings where 70% of companies reporting in the S&P 500 beat analyst expectations but stock movement was rather mute. However, companies that didn’t meet expectations or provided guidance of weaker trends next year tended to get punished. This might be indicative of a market priced for perfection. Even market leading technology stocks have been pulling back as a group since November.

Concern about pending market correction tends to be related to news rather than the economy, usually surrounding Trump & Co., North Korea and the Middle East, yet in the economy, unemployment rates remain low as do interest rates. Further, markets can appear expensive for long periods of time and of course, contractions in the stock market are normal, so don’t try to time them. Have a bit of cash.

I have prepared this commentary to give you my thoughts on various investment alternatives and considerations which may be relevant to your portfolio. This commentary reflects my opinions alone, and may not reflect the views of National Bank Financial Group. In expressing these opinions, I bring my best judgment and professional experience from the perspective of someone who surveys a broad range of investments. Therefore, this report should be viewed as a reflection of my informed opinions rather than analyses produced by the Research Department of National Bank Financial.

National Bank Financial

Rob Hunter

Vice President

Senior Investment Advisor

Sources: Reuters, Stockcharts.com, Technical Speculator, NBF Economics

National Bank Financial is an indirect wholly-owned subsidiary of National Bank of Canada. The National Bank of Canada is a public company listed on the Toronto Stock Exchange (NA: TSX).

This information was prepared by Rob Hunter, Senior Investment Advisor with National Bank Financial. The particulars contained herein were obtained from sources that we believe reliable but are not guaranteed by us and may be incomplete.

The opinions expressed are based on our analysis and interpretation of these particulars and are not to be construed as solicitation or offer to buy or sell the securities mentioned herein. National Bank Financial may act as financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive remuneration for its services. Rob Hunter, National Bank Financial and/or its officers, directors, representatives, and associates may have a position in the securities mentioned herein and may make purchases and / or sales of these securities from time to time in the open market or otherwise.

The opinions expressed herein do not necessarily reflect those of National Bank Financial.

The investment advice given only applies to residents of the provinces of British Columbia, Alberta, Manitoba and Ontario.

National Bank Financial is a member of the Canadian Investor Protection Fund.