Market Update December 2022

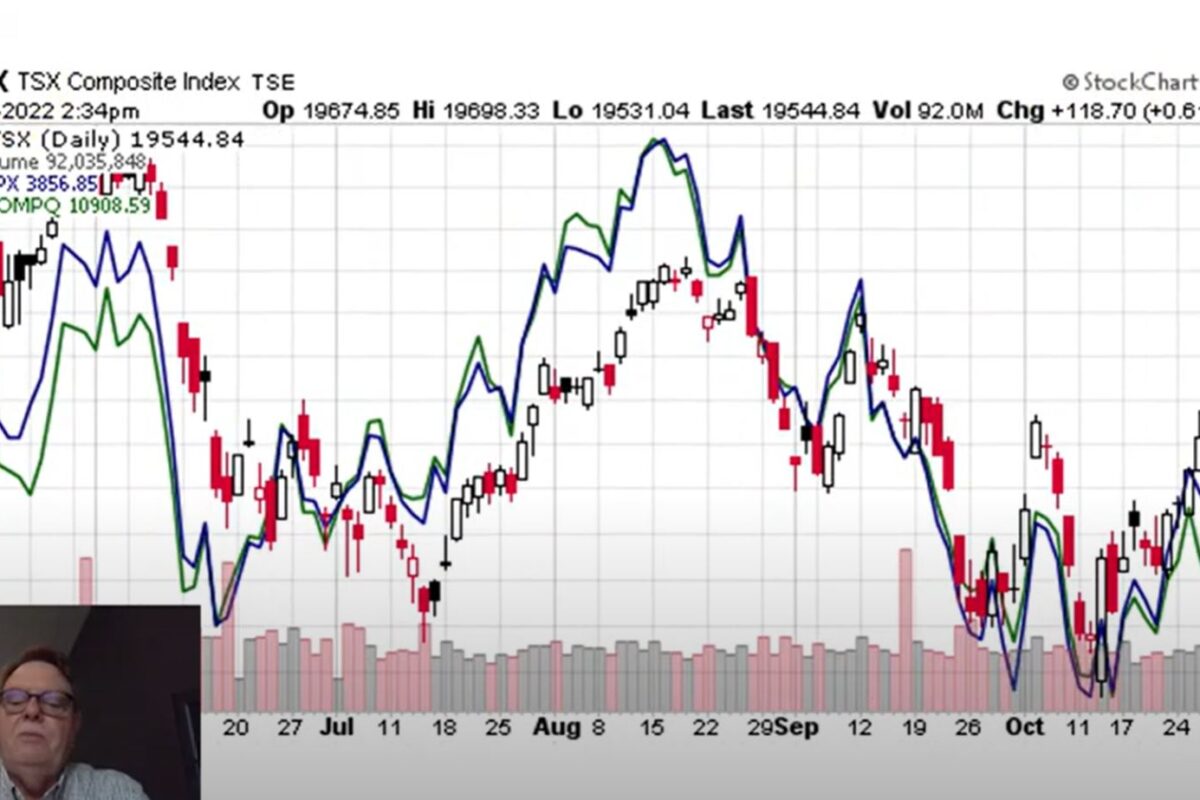

North American Markets have continued to rally after bottoming mid-October. As the market believes that central banks are finished aggressive interest rate hikes to counter inflation, I believe the market will respond positively.

The S&P 500 Index is up nearly 15 per cent from the October lows at Nov 23. Fundamentally, the S&P 500 index is now trading at a discount to its 10-year historical average. Technically, since 1950, the S&P500 has never produced a negative one-year return following a U.S. midterm election (BNN Nov 23/22).

I continue to favour financial and energy sectors here in Canada as these sectors tend to perform well in an inflationary environment. Expect technology (U.S.) to be weak until a transition to a more dovish interest rate policy, sometime I believe in 2023. As a result, I suggest pushing out new U.S. call option maturities to maximize premium income while you wait.

The U.S. has had an inverted yield curve for 22 weeks which historically has served as a strong predictor of recession. Fast rising interest rates serve to squeeze the availability of money in the economy. Put another way, the Federal Reserve may be willing to risk recession as a cost of combatting inflation. If so, I don’t believe it would be long in nature as most businesses are starving for more labour and you may have noticed the Canadian Federal government recently announcing that it wants to bring in much more educated labour via immigration.

While all North American markets have been moving up out of October lows, the strength remains in Canada which is now down <3.95%> YTD

If you missed my charts comparing returns for banks, utilities, and technology stocks both YTD and over the last decade, you can view my October Update here:

https://rhunterwealth.ca/october-market-update-2022/

2023 TAX INFORMATION:

Working clients

- Maximum RRSP contribution: The maximum contribution for 2023 is $30,780; for 2022, it’s $29,210. The 2024 limit is $31,560.

- TFSA limit: In 2023, the annual limit is $6,500, for a total of $88,000 for someone who has never contributed and has been eligible for the TFSA since its introduction in 2009. The annual limit for 2022 is $6,000, for a total of $81,500 in room available in 2022 for someone who has been eligible since 2009.

- Maximum pensionable earnings: For 2023, the maximum pensionable earnings amount is $66,600 (up from $64,900 in 2022), and the basic exemption amount remains $3,500 for 2022 and 2023.

- Maximum EI insurable earnings: The maximum annual insurable earnings (federal) for 2023 is $61,500, up from $60,300 in 2022.

- Lifetime capital gains exemption: The lifetime capital gains exemption is $971,190 in 2023, up from $913,630 in 2022.

- Low-interest loans: The family loan rate until Dec. 31 is 3%.

- Home buyers’ amount: Did you buy a home? You may be able to claim up to $5,000 of the purchase cost, and get a non-refundable tax credit of up to $750. (Legislation is pendingthat would double the amount to $10,000 for a non-refundable tax credit of up to $1,500.)

- Medical expenses threshold: For the 2023 tax year, the maximum is 3% of net income or $2,635, whichever is less. For 2022, the max is 3% or $2,479.

- Basic personal amount: The basic personal amount for 2023 is $15,000 for taxpayers with net income of $165,430 or less. At income levels above $165,430, the basic personal amount is gradually clawed back until it reaches $13,521 for net income of $235,675. The basic personal amount for 2022 ranges from $12,719 to $14,398.

Older clients

- Age amount: You can claim this amount if they were aged 65 or older on Dec. 31 of the taxation year. The maximum amount that you can claim in 2023 is $8,396, up from $7,898 in 2022.

- OAS recovery threshold: If your net world income exceeds $86,912 in 2023 or $81,761 in 2022, you may have to repay part of or the entire OAS pension.

- Lifetime ALDA dollar limit: The limit is $160,000 for both 2023 and 2022.

Clients with children, dependants

- Canada caregiver credit: If you have a dependant under the age of 18 who’s physically or mentally impaired, you may be able to claim up to an additional $2,499 in 2023 and $2,350 in 2022 in calculating certain non-refundable tax credits. For infirm dependants 18 or older, the amount for 2023 is $7,999 and the 2022 amount is $7,525.

- Disability amount: This non-refundable credit is $9,428 in 2023 ($8,870 in 2022), with a supplement up to $5,500 for those under 18 ($5,174 in 2022) that is reduced if child care expenses are claimed.

- Child disability benefit: The child disability benefit is a tax-free benefit of up to $3,173 in 2023 ($2,985 in 2022) for families who care for a child under 18 with a severe and prolonged impairment in physical or mental functions.

- Canada child benefit: In 2023, the maximum CCB benefit is $7,437 per child under six and up to $6,275 per child aged six through 17. In 2022, those amounts are $6,997 per child under six and up to $5,903 per child aged six through 17.

Federal tax brackets

Federal bracket thresholds will be adjusted higher in 2023 by 6.3%.

- The 33.0% tax rate begins at taxable income of over $235,675, up from $221,708 in 2022.

- The 29.0% tax rate begins at taxable income of over $165,430, up from $155,625 in 2022.

- The 26.0% tax rate begins at taxable income of over $106,717 up from $100,392 in 2022.

- The 20.5% tax rate begins at taxable income of over $53,359, up from $50,197 in 2022.

- Income up to $53,359 is taxed at 15.0%.

Christmas & New Year’s Office Closures:

Our office will be closed Monday December 26th, Tuesday December 27th, and Monday January 2nd (2023)

If you have any questions or would like to discuss any aspect of your portfolio or market, my team and I are a phone call away.

I have prepared this commentary to give you my thoughts on various investment alternatives and considerations which may be relevant to your portfolio. This commentary reflects my opinions alone and may not reflect the views of National Bank Financial Group. In expressing these opinions, I bring my best judgment and professional experience from the perspective of someone who surveys a broad range of investments. Therefore, this report should be viewed as a reflection of my informed opinions rather than analyses produced by the Research Department of National Bank Financial.

Best regards,

National Bank Financial

Rob Hunter

Senior Wealth Advisor

Sources: Stockcharts.com, Reuters, Bloomberg, BNN, Advisor.ca

National Bank Financial is an indirect wholly-owned subsidiary of National Bank of Canada. The National Bank of Canada is a public company listed on the Toronto Stock Exchange (NA: TSX).

This information was prepared by Rob Hunter, a Senior Wealth Advisor with National Bank Financial. The particulars contained herein were obtained from sources that we believe reliable but are not guaranteed by us and may be incomplete.

The opinions expressed are based on our analysis and interpretation of these particulars and are not to be construed as solicitation or offer to buy or sell the securities mentioned herein. National Bank Financial may act as financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive remuneration for its services. Rob Hunter, National Bank Financial and/or its officers, directors, representatives, and associates may have a position in the securities mentioned herein and may make purchases and / or sales of these securities from time to time in the open market or otherwise.

The opinions expressed herein do not necessarily reflect those of National Bank Financial.

Several of the securities mentioned in this article may not be followed by National Bank Financial’s Research department. The investment advice given only applies to residents of the provinces of British Columbia, Alberta, Manitoba, Ontario and Quebec. National Bank Financial is a member of the Canadian Investor Protection Fund.