Market Update May 2024

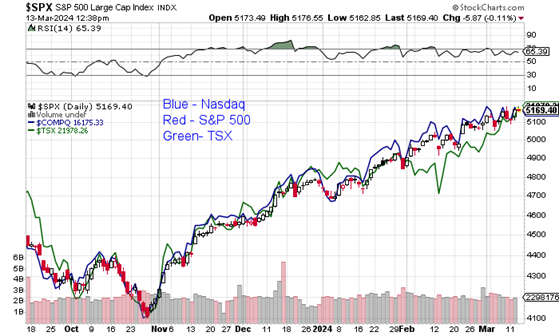

Since my last update in March, markets have retracted a little bit after a strong run of performance in the U.S. market followed by somewhat weaker performance here in Canada. In particular, we can see retraction the U.S. technology sector in the last 4-6 weeks.

YTD Market Performance…

TSX +3.3% Canadian broad market

SPX 5.2% U.S. broad market

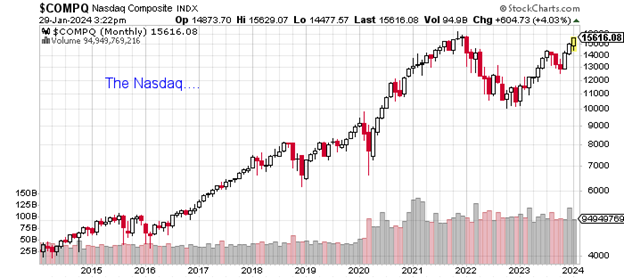

Nasdaq 4.5% U.S. technology focused index

A tale of two markets.

The American economy is doing quite well and I think that is being reflected in the broader SPX market performance. Interest sensitive technology stocks have pulled back a bit recently as predictions for interest rate cuts are not as relevant today. With a stronger economy than many thought six months ago, the central bank in the U.S. isn’t likely in any hurry to start cutting interest rates today, particularly as they have stated a desire to see inflation get down to 2%. Globally, the U.S. market is providing growth in our portfolios.

Here in Canada we have a much more challenging economy.

Government spending is excessive in an economy where most job creation is in the public, not private sector. Government debt has increased substantially as has taxation. The Federal budget this week provided a new Federal wealth tax, increasing the taxable portion of capital gains to 66.7% from 50% if your gains are over $250,000 (individual). This is a rude awakening for anyone with assets beyond their personal residence. (I have included a summary of the Federal Budget separately).

We have sought to weight Canadian portfolios to the Financials (banks) over the last year or so which has worked out well. However, I believe banks will be anchored to arguably almost zero GDP growth if you factor out immigration. Productivity in Canada is currently ‘zero’. While we have enjoyed constant dividend growth in this sector, that will likely get muted over the near future. The banks with the best ROE right now appear to be National and RBC.

Another sector we have favoured is Energy which has performed fairly well on the production side though infrastructure (pipes) remains weak. I believe this will change as we have two pipelines to tidewater about to open here in Canada. As confusing as it may sound, the Federal government owns the Trans Mountain pipeline on one hand, while seemingly being opposed to fossil fuels on the other. Oil and gas remain a very significant source of revenue for Canada while our carbon taxes are among the highest in the world. Canada is responsible for 1.4% of global C02 emissions. The good news about energy to tidewater is that demand will allow us to finally realize world pricing for this commodity as opposed to selling it for what we can realize from our only current market, the U.S. This is particularly relevant with the new LNG facility at Kitimat opening soon where ships can be directed to where the demand and money is for LNG.

Summary.

I think that there is more likelihood of Canada reducing interest rates than the U.S. in the coming months. I believe Canada is slipping toward recession and stimulus might come in rate cuts. Inflation in March came in at 2.9%.

I often hear Canada compared to Australia because like Australia, we are arguably, the most resource rich countries on the earth. When comparing Canada to other countries, I have often said, that ‘our wealth is beneath our feet’. However, while both countries are resource rich, Australians are considered to be 20% wealthier than Canadians.

I have prepared this commentary to give you my thoughts on various investment alternatives and considerations which may be relevant to your portfolio. This commentary reflects my opinions alone and may not reflect the views of National Bank Financial Group. In expressing these opinions, I bring my best judgment and professional experience from the perspective of someone who surveys a broad range of investments. Therefore, this report should be viewed as a reflection of my informed opinions rather than analyses produced by the Research Department of National Bank Financial.

Best,

National Bank Financial

Rob Hunter

Senior Wealth Advisor

Sources: National Bank Economics, Hamilton ETFS, BNN, Bloomberg

National Bank Financial – Wealth Management (NBFWM) is a division of National Bank Financial Inc. (NBF), as well as a trademark owned by National Bank of Canada (NBC) that is used under license by NBF. NBF is a member of the Canadian Investment Regulatory Organization (CIRO) and the Canadian Investor Protection Fund (CIPF), and is a wholly-owned subsidiary of NBC, a public company listed on the Toronto Stock Exchange (TSX: NA).

This information was prepared by Rob Hunter, a Senior Wealth Advisor with National Bank Financial. The particulars contained herein were obtained from sources that we believe reliable but are not guaranteed by us and may be incomplete.

The opinions expressed herein do not necessarily reflect those of National Bank Financial. The particulars contained herein were obtained from sources we believe to be reliable, but are not guaranteed by us and may be incomplete. The opinions expressed consider a number of factors including our analysis and interpretation of these particulars, such as historical data, and are not to be construed as a solicitation or offer to buy or sell the securities mentioned herein. Unit values and returns will fluctuate and past performance is not necessarily indicative of future performance. Important information regarding a fund may be found in the prospectus. The investor should read it before investing.

The opinions expressed herein do not necessarily reflect those of National Bank Financial. Several of the securities mentioned in this article may not be followed by National Bank Financials’ Research department.

The securities mentioned (inclusive of option strategies) in this article are not necessarily suitable to all types of investors. Please consult your investment advisor to discuss investment risks. All prices and rates are subject to change without notice. Stocks typically fluctuate in value. Stock values can go to zero.

Selling calls against stock (Covered Writing): Shares may need to be sold at the strike price of the option at any time prior to expiration. If the calls are assigned, further opportunity for appreciation in the underlying security above the strike price is foregone.

Risk/Reward of the strategy = Strike price minus the purchase price of the underlying plus the premium received from the sale of the call. The maximum loss is the same as holding a long position less the premium received.

The investment advice given only applies to residents of the provinces of British Columbia, Alberta, Manitoba, Saskatchewan, Ontario, New Brunswick and Quebec.

National Bank Financial is a member of the Canadian Investor Protection Fund.