Market Update March 2024

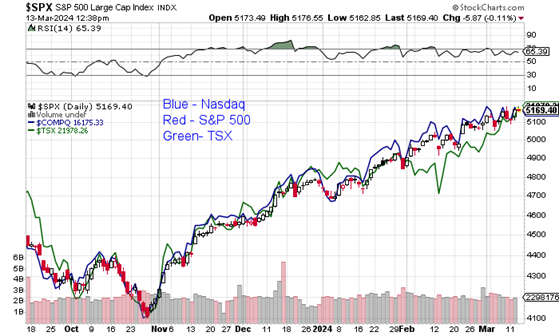

Market breadth has expanded since my last update. More stocks are participating in this market rally. In particular, the lagging Canadian market (TSX) in green above is starting to narrow the gap with the leading U.S. markets since mid-February.

Here is market performance YTD:

Top spot goes to the broader S&P 500 +8.41%

Nasdaq (tech index) +7.8%

Canada’s TSX coming up in the rear +4.87%

81% of stocks in the S&P500 are now trading above their 200 day moving average.

68% of stocks in the TSX are now trading above their 200 day moving average.

In short, the market has continued to rally out of last year’s October lows, climbing the wall of worry from inflation, interest rates, trade, geopolitical tensions, election fears.

Maureen Peters.

Most everyone is very familiar with our administrative lead, Maureen who has been with my team for seven years. Maureen is retiring at the end of this month. She has been an invaluable part of my team and will be missed as she prepares to greet another grandchild. If you like hanging out on rock walls, you might bump into her at the climbing centre here in Victoria! Best wishes for a great retirement Maureen!

Introducing Comet Tang.

Of course, our administrative team will continue with Stephanie Hunter and our newest team member, CometTang. Comet has a degree in Chemistry with a minor in Business, which has translated into great analytical skills. He is tech savvy and we are enjoying his friendly nature and enthusiasm for our business. Welcome Comet!

I have prepared this commentary to give you my thoughts on various investment alternatives and considerations which may be relevant to your portfolio. This commentary reflects my opinions alone and may not reflect the views of National Bank Financial Group. In expressing these opinions, I bring my best judgment and professional experience from the perspective of someone who surveys a broad range of investments. Therefore, this report should be viewed as a reflection of my informed opinions rather than analyses produced by the Research Department of National Bank Financial.

Best,

National Bank Financial

Rob Hunter

Senior Wealth Advisor

Sources: Stockcharts.com, BNN, Bloomberg

National Bank Financial – Wealth Management (NBFWM) is a division of National Bank Financial Inc. (NBF), as well as a trademark owned by National Bank of Canada (NBC) that is used under license by NBF. NBF is a member of the Canadian Investment Regulatory Organization (CIRO) and the Canadian Investor Protection Fund (CIPF), and is a wholly-owned subsidiary of NBC, a public company listed on the Toronto Stock Exchange (TSX: NA).

This information was prepared by Rob Hunter, a Senior Wealth Advisor with National Bank Financial. The particulars contained herein were obtained from sources that we believe reliable but are not guaranteed by us and may be incomplete.

The opinions expressed herein do not necessarily reflect those of National Bank Financial. The particulars contained herein were obtained from sources we believe to be reliable, but are not guaranteed by us and may be incomplete. The opinions expressed consider a number of factors including our analysis and interpretation of these particulars, such as historical data, and are not to be construed as a solicitation or offer to buy or sell the securities mentioned herein. Unit values and returns will fluctuate and past performance is not necessarily indicative of future performance. Important information regarding a fund may be found in the prospectus. The investor should read it before investing.

The opinions expressed herein do not necessarily reflect those of National Bank Financial. Several of the securities mentioned in this article may not be followed by National Bank Financials’ Research department.

The securities mentioned (inclusive of option strategies) in this article are not necessarily suitable to all types of investors. Please consult your investment advisor to discuss investment risks. All prices and rates are subject to change without notice. Stocks typically fluctuate in value. Stock values can go to zero.

Selling calls against stock (Covered Writing): Shares may need to be sold at the strike price of the option at any time prior to expiration. If the calls are assigned, further opportunity for appreciation in the underlying security above the strike price is foregone.

Risk/Reward of the strategy = Strike price minus the purchase price of the underlying plus the premium received from the sale of the call. The maximum loss is the same as holding a long position less the premium received.

The investment advice given only applies to residents of the provinces of British Columbia, Alberta, Manitoba, Saskatchewan, Ontario, New Brunswick and Quebec.

National Bank Financial is a member of the Canadian Investor Protection Fund.