Your 2017 Tax Return – Tax Reporting Information

With the tax-filing deadline fast approaching you may be in a rush to file your 2017 personal tax returns.

RRSP contribution deadline for 2017 is Thursday, March 1, 2018

Have you made an RRSP Contribution for 2017?

- Your contribution room is limited to 18% of income earned in 2016, with a maximum contribution of $26,010 less any pension adjustments. Your 2017 limit can be found on your 2016 Notice of Assessment.

- Convenient RRSP loans are available through our affiliation with National Bank.

Have you made a TFSA Contribution for 2018?

- Fact: Someone who has never contributed to a Tax Free Savings Account can now contribute up to $57,500.00. The 2018 contribution limit is $5,500.00

- To verify your TFSA contribution limits, please contact Canada Revenue Agency website http://www.cra-arc.gc.ca/myaccount/ or CRA directly @ 1-800-267-6999. NBF cannot be held liable for any over contribution penalties.

Income Trust or Limited Partnership Units

- Tax slips are not mailed until late March. Companies can file amendments. We suggest you wait until mid-April to file your personal tax return.

- 100% Return on Capital is recorded on the T3 and listed on the Summary of Trust Income Report.

- Reminder: If you have invested in (flow-through) Limited Partnership Units, please remember to use the tax credits applicable in future years. This is located on the final T5013 issued for any LPU. Keep copies to use these credits on your future tax returns.

- Rob suggests that clients participating in flow-through limited partnerships or options have an accountant complete their tax return. If you do not have an accountant, please feel free to contact our office for a referral.

The average U$ currency rate for 2017 is 1.2986 (applicable if you are reporting U$ capital gain/loss). Source: Bank of Canada – Financial Markets Department

Allowable capital losses can be applied against any capital gains for the previous 3 years (2014, 2015, 2016) or carried forward indefinitely.

If you require a Capital Gain/Loss Report (taxable accounts) for your 2017 Personal Tax Return, please feel free to contact me at (250) 953-8415 or by e-mail at [email protected]

On-line Services – if you would like to view your NBF accounts on-line, please contact me for access.

- You can now receive your monthly statements, trade confirmations and tax slips on-line too!

Your personal tax return must be filed prior to mid-night of April 30th, 2018

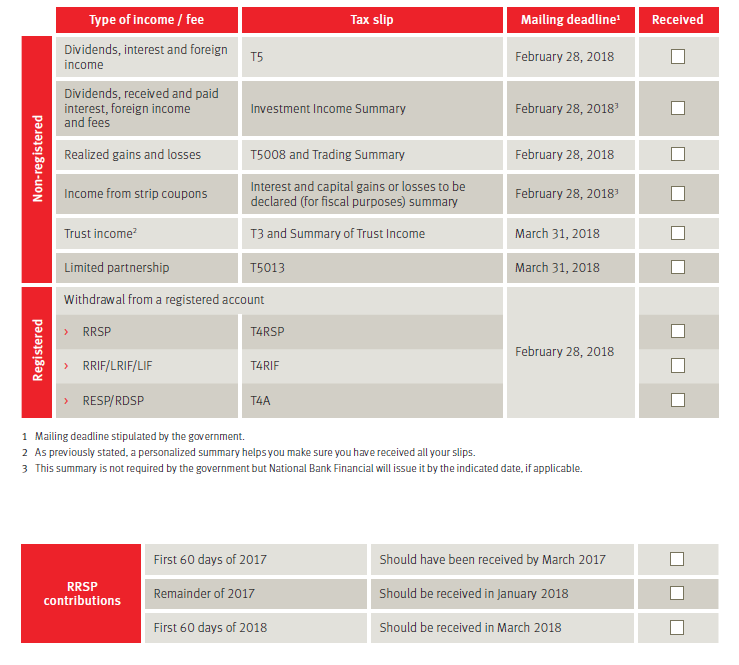

Have you received all your tax slips?

This table lists the various Canadian slips and forms that may be needed to prepare your income tax return. Since these documents reflect the transactions and income recorded during the year, some may not apply to your situation. Before completing your tax return, please ensure that you have received all your tax slips to avoid having to file an amended return.

Please feel free to contact me if I can be any further assistance to you.

National Bank Financial is an indirect wholly-owned subsidiary of National Bank of Canada. The National Bank of Canada is a public company listed on the Toronto Stock Exchange (NA: TSX). The particulars contained herein were obtained from sources we believe to be reliable, but are not guaranteed by us and may be incomplete. The opinions expressed are based upon our analysis and interpretation of these particulars and are not to be construed as a solicitation or offer to buy or sell the securities mentioned herein. The opinions expressed herein do not necessarily reflect those of National Bank Financial. The securities or sectors mentioned herein are not suitable for all types of investors. Please consult your investment advisor to verify whether the securities or sectors suit your investor’s profile as well as to obtain complete information, including the main risk factors, regarding those securities or sectors.

Please consult your tax advisor regarding your particular situation. National Bank Financial is not a tax advisor and clients should seek professional advice on tax-related matters. Please note that comments included on this website are not intended to be a definitive analysis of tax law. The comments contained herein are general in nature and professional advice regarding an individual’s particular tax position should be obtained in respect of any person’s specific circumstances.